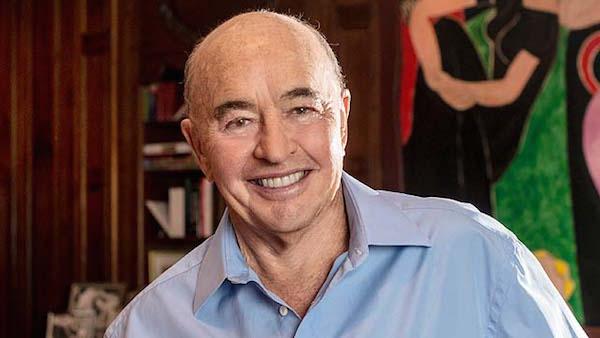

Joe Lewis—billionaire art collector, currency trader, and owner of the Tottenham Hotspur soccer club—was charged with insider trading and financial fraud in New York today.

Damian Williams, the U.S. Attorney for the Southern District of New York, and Christie Curtis, acting director in charge of the FBI’s New York field office, announced the unsealing of an indictment against Lewis and two co-conspirators. All were arrested this morning and were scheduled to appear in court later today.

The charges against Lewis include that he orchestrated “a brazen insider trading scheme,” according to a statement by Williams that accompanied the 29-page indictment. “For years, Joe Lewis abused his access to corporate boardrooms and repeatedly provided inside information to his romantic partners, his personal assistants, his friends, and his pilots. Those folks then traded on that inside information—and made millions of dollars in the stock market.”

Lewis, already a wealthy man, “used inside information as a way to compensate his employees or to shower gifts on his friends and lovers,” Williams said in the statement.” That’s classic corporate corruption. It’s cheating. And it’s against the law—laws that apply to everyone, no matter who you are.” According to , Lewis’ current net worth is $6.1 billion.

Lewis, who is 86 and a British national, was hit with 16 counts of securities fraud and three counts of conspiracy. The charges each carry maximum sentences ranging from five to 20 years in prison.

According to the U.S. attorney statement and the indictment, Lewis received non-public information, such as, for example, imminent positive test results for biochemical companies as a result of his involvement with the boards of certain companies. Lewis allegedly misused and misappropriated the information to provide stock tips to individuals he knew and employed on multiple occasions. In one case he passed on information to two pilots he employed: Patrick O’Connor and Bryan Waugh. The two men were also named in the indictment.

In one instance, Lewis gave each man loans worth $500,000 so they could buy a company’s stock before the public release of favorable clinical results. Lewis’ lawyer did not immediately respond to request for comment.

Lewis has been a major player in the art market for decades. In 2015, he was revealed as the buyer of Gustav Klimt’s (1902) sold at Sotheby’s London in June of that year for $39 million. An investigation conducted by the Austrian daily revealed the acquisition.

Pablo Picasso Femmes d’Alger (1955).

Photo; Courtesy Christie’s.

In 2016, the “Panama Papers” leak revealed that the landmark 1997 sale of the Victor and Sally Ganz collection at Christie’s was actually orchestrated by Lewis. The $206 million sale was conducted via Simsbury International Corp., a company, the papers note, which “appears to have been created solely for the Ganz transaction.” At the time, the sale set a private collection auction record, with Pablo Picasso’s fetching a then-astounding $31.9 million. The transaction is still considered a watershed moment in the auction world.

went on to sell for even more 18 years later, when it came back on the auction block at Christie’s and sold for a whopping $179.4 million.

The secret behind the November 1997 sale was that Lewis had already cherry-picked the best of the Ganz collection from a Christie’s subsidiary, London’s Spink & Son, on May 2 of that year. The same day, terms were drawn up for an auction at Christie’s, with the understanding that Lewis and Spink would share equally any profits from the sale above $168 million.

In other words it was an auction guarantee, well before auction guarantees were officially a thing. If the works failed to find a buyer on the auction block, Lewis would pay for them. The auction catalogue noted that “Christie’s has a direct financial interest in all property in this sale,” but much of risk appeared to have been Lewis’s, who was also the auction house’s primary shareholder at the time.

The following year, in 1998, Lewis sold his Christie’s stake to French billionaire Francois Pinault, who remains Christie’s owner to this day.

More recently, Lewis was identified as the seller of David Hockney’s massive (1972) that sold for $90.3 million at Christie’s New York in November 2018. It originally sold at the André Emmerich gallery, in New York, for $18,000. Lewis bought the Hockney from fellow billionaire collector David Geffen in 1995.

As Artnet News reported at the time, Lewis declined a guarantee on the Hockney and offered it without a reserve, according to people familiar with the matter.