Those who recently descended on the South Korean capital for Seoul Art Week undeniably had a fun, if hectic, experience amid festivities anchored by Frieze Seoul and Kiaf Seoul. There were of course countless openings, VIP previews, and artist studios visits. But the machinations went beyond art—rubbing shoulders with star Lee Byung-hun, or a member of K-pop sensations BTS and/or Blackpink, was no more a fantasy for many a visiting fairgoer last week.

As many art-world players recuperate from the eventful week, some are also contemplating the future. As the art-fair calendar in Asia becomes increasingly crowded, including by several events with global ambitions, some are starting to look more closely at the math underpinning the fairs. Amid the macroeconomic situation and a global art market correction, many are questioning if the market in South Korea, or even Asia overall, can sustain such a saturated schedule.

Many gallerists exhibiting at both Seoul fairs last week told Artnet News that sales were obviously slower than last year. Seoul sales reported by galleries mostly clustered around five-digit figures. Only a handful, at Frieze, achieved six or seven-digit sales figures.

Meanwhile, some collectors who traveled to Seoul told Artnet News that they went home empty handed.

That leaves some doubt as to how enticing the city’s Art Week will be going forward.

“If Frieze Seoul can’t invite foreign collectors [to] Korea, we will face a limit,” Lee Joon Yub, director of the Daegu and Seoul-based Gallery Shilla, told Artnet News.

South Korean singer G-Dragon attends the Photo Call for ‘Chanel x Frieze’ cocktail reception event on September 06, 2023 in Seoul, South Korea. (Photo by The Chosunilbo JNS/Imazins via Getty Images)

Crowded Calendar

Ever since the stringent Covid travel restrictions were lifted gradually across Asia, just as Frieze Seoul was launching its first edition a year ago, the number of art fairs in Asia branded as “international,” has sprung up. Art SG in Singapore and Tokyo Gendai in Tokyo, both operated by the Art Assembly, have been added to the docket, while existing fairs including Art Basel Hong Kong and Taipei Dangdai (also by the Art Assembly) strive to revive their former glory, now that they can again welcome foreign visitors.

But to some galleries from Asia, keeping up with the busy schedule—which for some includes fairs in other parts of the world—is becoming more and more challenging, especially when sales don’t always meet expectations. Some gallerists said the cost of staging a booth in the region can go up to six digits, including booth rent, shipping, and hotel and travel expenses. “We barely broke even,” said one gallerist who showed at one of the aforementioned fairs.

Others complained that they could not make meaningful contacts during some of these fairs, as cultural barriers proved harder to surmount than expected. Some buyers who bought intensively during Covid have also slowed down their art purchases, another Seoul-based gallerist said.

Some questioned if the traditional art fair model—that is, bringing sellers to a convention center in various cities for just a few days—is the answer for the Asian market in the long run, especially when not all Asian cities have a large number of affluent art buyers. “The markets in some of these cities are still very nascent and it’s hard to justify and support over 100 galleries at each fair while ensuring each gallery is happy with sales,” an Asia-based gallerist said.

Installation view of Kiaf Seoul 2023. Courtesy Kiaf Seoul.

Urgent Need for “Asia-Level” Collaboration

While global brand names originated from the west such as Art Basel and Frieze have helped to stimulate the Asian market by launching outposts in the region, galleries in Asia nonetheless feel an urgent need for collaboration to make the art-fair trade sustainable there.

The Galleries Association of Korea, organizers of Kiaf, invited representatives from Taiwan Art Galleries Association and Asosiasi Galeri Senirupa Indonesia to the Seoul fair this year; all these galleries associations are members of the Asia Pacific Art Gallery Alliance (APAGA), which was founded in 2015. Other members include galleries associations from Singapore, Japan, and Hong Kong.

“There have been talks about cities like Shanghai, Hong Kong, Tokyo, Taipei, Singapore, and Seoul racing to be art hub in Asia,” Hwang Dalseung, chairman of the Galleries Association of Korea, told Artnet News. “But what about just having healthy competition among these cities? Shouldn’t we gravitate the art world to a broader region, like Europe and Americas? We need to work on an Asia level.”

Hwang revealed that galleries associations from three Asian regions are expected to join the alliance in the near future. He is also expecting exchange with Taiwan during the upcoming 30th anniversary of Art Taipei, which runs in October and is organized by the Taiwan Art Galleries Association.

Art Collaboration Kyoto (ACK), which will return for a third edition from October 27-30, could serve as a reference for a more collaborative model. The young fair, founded in 2021, will be featuring 26 Japanese galleries as “hosts,” sharing booths with 27 galleries from the Americas, Europe, and Asia Pacific, in addition to the 11 galleries presenting artists with specific connection with Japan’s former ancient capital. Following that weekend will be the return of Art Week Tokyo, which saw a successful experiment last year by bussing VIPs to local galleries, institutions, and private collections.

“Collaborative fairs like ACK may work better as Japanese galleries help western galleries, and the price of doing the fair is not as prohibitive,” Amanda Hon, co-president of Hong Kong Art Gallery Association, told Artnet News. “Art Week Tokyo, on the other hand, allow collectors to really discover the galleries, history, and culture in a much more in-depth way than simply going to an art fair.”

Artist Priyageetha Dia, featured at Yeo Workshop’s presentation at Frieze Seoul 2023. “Collaborations with other like-minded galleries in that market” could be a better alternative to art fairs in Asia, noted the gallery’s founder Audrey Yeo. Image courtesy of Yeo Workshop. Photo by Jonathan Tan.

Indelible Impression

Despite the slow sales at the recent Seoul fair week, confidence in the South Korean capital remains high. Some collectors and art patrons traveling to the city said the art on show at the fairs was “so-so,” but they were all impressed by what the city has to offer as a total cultural experience.

“Don’t just look at the art fairs,” Hong Kong collector and fintech exec Alan Lau, who visited Seoul’s art week for the first time, told Artnet News. “It is the cultural economy [that matters] and Korea is creating an alternative model of cultural tourism. They will have more international visitors.”

Seoul-based collector JaeMyung Noh personally welcomed nearly 300 visitors to his private collection during Art Week, including many museum groups and art professionals from the U.S. and Europe. He agreed that the market in Korea is not booming like it was two or three years ago. “However, I see many companies in Korea wanting to so something about art. Not just buying art, but collaborating or doing art-related projects,” he said, adding that attention that South Korea gets from the global community comes from “not just the Korean art scene but also the culture, food, K-pop, and drama (thanks to Netflix).”

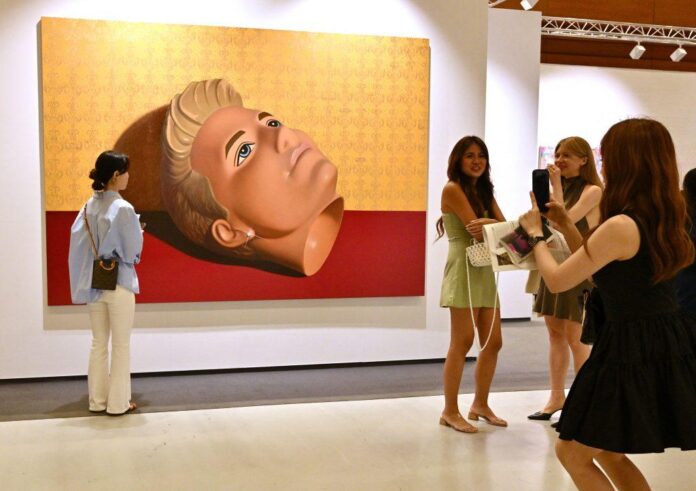

Visitors look at an artwork named “Weave Magenta, 2023” (R) by artist Sean Scully during the Frieze Seoul 2023 art fair in Seoul on September 6, 2023. (Photo by Jung Yeon-Je/AFP via Getty Images)

Lee of Gallery Shilla said Korean collectors respond to conceptual work more in recent years. The gallery paid homage to Italian conceptual artist Piero Manzoni’s (1961) in its booth, “The Great Shit Show,” at Kiaf this year. The gallery invited fairgoers to place silent bids on an installation by art collective El Grupo X, with each sealed can allegedly containing lyophilized feces from a different anonymous art world figure. Eventually, landed the highest bid and sold for $20,000. “We didn’t expect sales from our show. But the collectors know how to enjoy this,” Lee said.

And while Frieze and Kiaf have just wrapped up, another new fair is going to make its debut in Seoul. Staged by the organizers of Art Busan, Define Seoul will take place from November 1 to 5, 2023, in the Seongsu district’s Layer Studios and Andy’s 636 spaces. With South Korean designer Teo Yang as its artistic director, the boutique fair features a mix of 25 art galleries and design studios, and targets local collectors in their 30s and 40s. Works on show are expected sell for between $20,000 and $1 million, according to Seokho Jeong, managing director of Art Busan.

“Sales have slowed down in terms of total sales volume but … the collector base in Korea has noticeably expanded and widened in the past five years, mainly led by [collectors in their 30s and 40s],” Jeong said. “The key local players, including ourselves, must continue to think hard how we can have more active, strong programs that could reach the global audiences on our own, instead of expecting Frieze and other international galleries to make it all happen for us.”

More Trending Stories:

Price Check! Here’s What Sold—and For How Much—at Frieze Seoul 2023