Earlier this month, Christie’s held a special auction of work by Marc Chagall as the prelude to its 20th and 21st century evening sales in London and Paris. The trove of fresh-to-market works consigned directly from the artist’s estate surpassed expectations, bringing in £9.7 million ($11.9 million) and exceeding its pre-sale high estimate of £6.5 million ($7.9 million). There was competition for all 20 lots, with many doubling expectations.

Some attributed the heightened interest to the forecasted recession: At moments of uncertainty, when art is seen as a hedge against inflation, buyers look to park their cash in established names. Though Chagall rarely generates headline-worthy fireworks at auction, the prolific Russian-French painter is among the more frequently traded and is commonly cited as a safe investment alongside the likes of Picasso, Monet, Basquiat, and Warhol.

But exactly how impervious is Chagall to wider market volatility? We took to artnet’s price database to investigate.

The Context

Auction Record: $28.5 million, achieved at Sotheby’s New York in November 2017

Chagall’s Performance in 2021

Lots sold: 887

Bought in: 260

Sell-through rate: 77.3 percent

Average sale price: $88,803

Mean estimate: $62,119

Total sales: $78.8 million

Top painting price: $6.2 million

Lowest painting price: $111,633

Lowest overall price: $88 for a lithograph of an image from Chagall’s “Bible Series”

© 2022 Artnet Worldwide Corporation.

The Appraisal

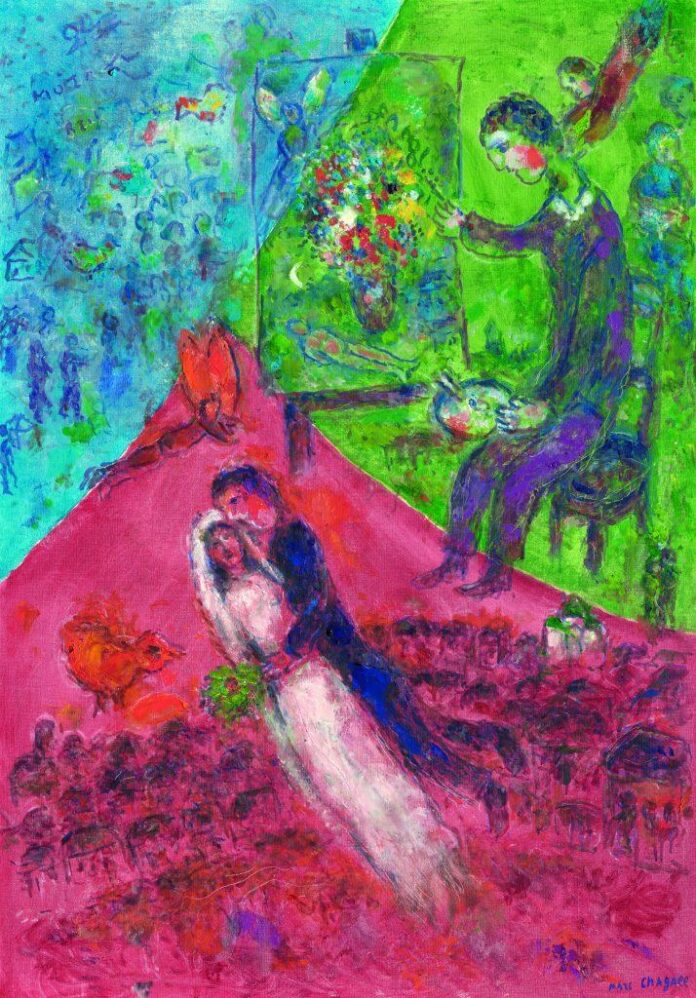

- Size matters. The most sought-after Chagalls are, unsurprisingly, the larger, more colorful oil paintings. A blue Chagall canvas featuring romantic subject matter—such as brides and grooms or flower bouquets—is on the wish list of many buyers looking to build a blue-chip 20th century art collection. Later works also contain recognizable motifs from Chagall’s lexicon, including goats and musical instruments.

- Lost paintings. Chagall’s most storied chapter is widely considered to be his first Paris period, when he was working alongside the early avant-gartistes in the years leading up to 1922. But these are few and far between—many were lost during both world wars, and most of the surviving examples are locked away in museum collections. While Chagall began repainting some of his earlier lost masterpieces after 1922—including the 1928 painting that set the artist’s auction record—the originals would likely have commanded considerably higher prices, perhaps on par with those for leading Picassos.

- Opportunity in paper. One strategic opportunity to buy is works on paper, which remain overlooked. You could pick up a small oil painting for under $500,000, but it would be not as finished, and would likely be smaller, than the colorful works on paper you can get for the same amount of money.

- Geographic spread. Today’s Chagall buyers broadly fall into two geographical camps. Those in far East Asia and mainland China are focused on the high end: oil paintings priced above $500,000. They largely replaced Russian buyers after those collectors receded in the midst of the credit crunch and sanctions imposed following the 2014 annexation of Crimea. Below the $500,000 threshold, meanwhile, interest is concentrated in Europe and North America. These are buyers who have been in the market longer and are seeking to collect in-depth, including works on paper and smaller sketches in oil. They also hold out the top dollar for his rare-to-market early pre-war works done in his more naive, folkloric, Russian style.

- Hedge time. Chagall has withstood wider market recalibrations before, including the Japanese market crash in the late 1980s and the 2008 financial downtown. This might go some ways toward explaining why, against the backdrop of another forthcoming recession, a whopping 19,370 users searched artnet’s price database for information on Chagall in the past 12 months.

Bottom Line

Marc Chagall in August, 1934, in front of “Solitude” (1933). Photo by Roger Viollet via Getty Images.

While the above-par results for Christie’s Chagall sale could be explained by the size, color, condition, and pristine provenance of the works on offer, it’s hard to ignore the role played by the broader economic climate.

The market for Chagall is huge, global, and has proven relatively impervious to crisis in the past. Even when certain regions have pulled back, others have been waiting in the wings to replace them. To wit: Japanese buyers were supplanted by Russians in the 1990s, who have in turn been replaced by buyers in the Asia Pacific region. Meanwhile, when prices take a dip, they swiftly recover, suggesting that those looking to the art market to diversify their assets can still count on Chagall as a safe bet.

That said, a slowdown in buying from the Asia Pacific region, which has fueled the wider art market growth since the dawn of the pandemic and currently lifts up the higher end of the Chagall market, is beginning to make itself felt. What this will mean for Chagall, and for insiders’ efforts to encourage that pool of buyers to collect the artist in-depth, remains to be seen.