Non-fungible tokens (NFTs) are having a moment. They’re making headlines in art, sports, fashion, and video games and they’re attracting increased interest from investors. But what is an NFT, really, and why do people buy them? If you work in media, or art, or sports, or law do you really need to care? We’ve been covering the explosion of NFTs and in this guide we’ve collected all our coverage as well as the best outside resources to help you understand what’s real and what’s hype. Grab your private key and get your metadata ready, we’re diving into NFTs.

Today there is nothing but talk about NFT. One of the recent sensational cases is a digital painting by the artist Beeple, sold at auction at Christie’s for $69.35 million. In this article, we will analyze what NFT-tokens are and how they influence the development of the creative industry.

NFT (Non-Fungible Token) are non-exchangeable tokens (a token is the equivalent of securities in the digital world). The definition of ‘NFT’ covers any digital content – audio, video, photos, domain names, even tweets. Whereas in the case of bitcoin, when you exchange one unit of currency for another, you don’t see a difference, in the case of NFT each token is individual, which ensures that it is not interchangeable. For example, your table is a non-interchangeable asset because you can exchange it for another table, but it won’t be equal to yours. But that doesn’t mean it’s unique – tokens can be issued in limited quantities. NFT is blockchain-based, which provides complete transparency in token transfer.

В

In general terms, an NFT is a certificate of ownership of a piece of digital art. However, this does not mean that by purchasing an NFT token, the buyer gets the copyright to the work. Buying an NFT could be compared to buying a painting: you purchase an original Van Gogh work, but it is still a Van Gogh work and remains available as prints and digital copies for anyone who wishes to buy it. While collecting physical art objects is often about the pleasure of ownership, NFT is more about investment: buy now to resell later.

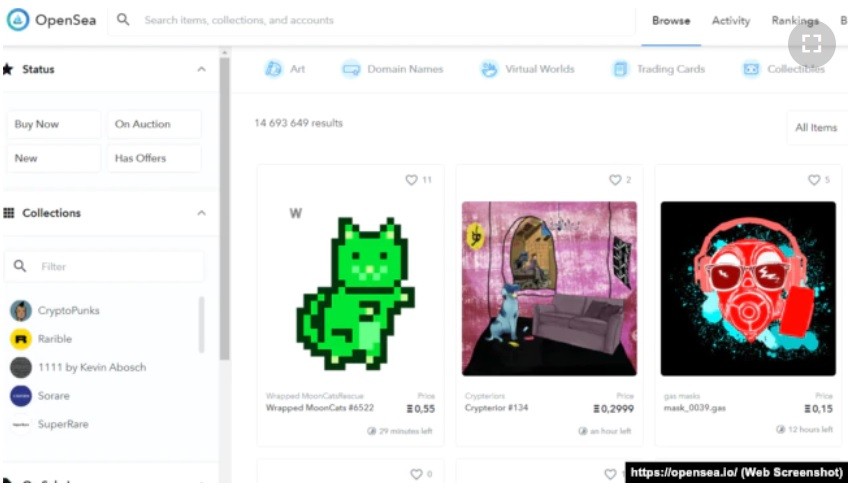

NFT is a huge plus for “creators”: tokens involve direct interaction between the buyer and the creator. At NFT-marketplaces it is not necessary to be a full-fledged creator – anything and everything can be bought, the material value is determined chaotically. If the result of creativity was bought more than once, the author receives a percentage for each subsequent transaction. Being honored with a place in the gallery is much more difficult. Often, part of the profit from selling an art object through a gallery is taken by intermediaries, in the form of curators. Marketplaces that sell tokenized art can also charge a commission – that’s how the Ethereum network works. But there are marketplaces like OpenSea that spare users the extra cost. NFT is a different kind of art, so critics and dealers have to rethink their aesthetic ideas. The Hermitage Museum did just that: on March 25, an announcement about Russia’s first NFT token art exhibition appeared on the website.

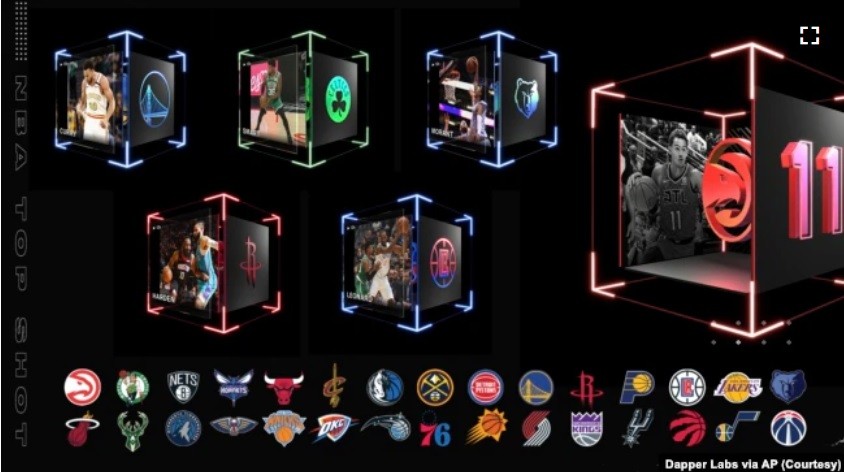

NFTs have existed since 2014, and the “boom” of interest came in 2017 when people began to buy up Crypto Kitties – images of kittens recorded using blockchain. Their value at peak moments reached hundreds of thousands of dollars. Today, the most profitable NFT project is the NBA Top Shot. National Basketball League fans can purchase tokenized recordings of LeBron James’ best shots-the modern digital equivalent of collectible basketball cards. One such NFT token is worth $240,000. Luxury brands are also seeking to enter NFT – Gucci recently announced its intention. No one wants to be left out: NFT is a great way to make money not only for art lovers but also for brand fans.

NFT is a major ethical controversy. Copyright is also an issue: it is not uncommon for people to resell copies of other people’s work. Transactions also cause enormous energy consumption. The amount of greenhouse gas emissions per year of operation is comparable to that of Sweden. The economic prospects of NFT remain unclear – some call it another bubble, while others have no doubts about its success, citing bitcoin as an example. Cryptocurrency goes through ups and downs – NFT is likely to meet the same fate. It makes no sense to build a cult around NFT. This is just a milestone in the development of cryptocurrency, which accidentally touched the field of art and showed: everything in the digital is an art object.

NFT is a relatively new phenomenon that is, however, increasingly in the news headlines.

What is NFT?

The abbreviation NFT (non-fungible tokens) means “non-interchangeable token. To understand tokens, it is necessary to understand the environment in which they exist – in this case, the blockchain.

To keep it very simple, a blockchain is a database that is stored simultaneously on a huge number of computers. In the traditional Internet model, all devices are connected to centralized nodes (in the form of servers or ISPs), whereas blockchain works in a different way. It does not have any central nodes; in its system, all devices simultaneously store all the information published on the blockchain.

Tokens, in turn, are a register entry within this blockchain. The distinguishing feature of most tokens is the principle of interchangeability. It can be compared to currency (including cryptocurrency): one dollar, one ruble or one bitcoin can be easily replaced by one dollar, one ruble or one bitcoin belonging to another user.

However, it is clear that not all digital assets are fungible. A painting by Pablo Picasso is not identical to a work by Claude Monet, and an mp3 file of The Beatles song can hardly be replaced with a recording of an Eminem concert. That is why the format of non-interchangeable tokens was created in order to transfer unique items to blockchain.

Each NFT is unique and exists in a single copy, it cannot be shared, and all information about its author, buyer and all transactions with it are securely stored in a blockchain. In other words, an NFT is a digital certificate attached to a unique object.

What can you sell in an NFT form?

In fact, anything. Music, images, text, videos, 3D models – that is, any digital product claiming to be unique:

Particular attention is paid to NFT by collectors (who, if not them, should search for unique items), gamers (who are interested in in-game items: skins, weapons, collectible cards, etc.), as well as artists and art lovers. And art lovers in all its forms.

Singer Grimes (she is also the mother of a boy named XÆA-12, a child of Ilon Musk) sold her drawings in the NFT format, raising $5.8 million for them, and Russian artist Pokras Lampas sold a projection of his drawing at the Chirkei hydroelectric power plant for $28 thousand.

DJ 3LAU became the first musician to sell his album, receiving $11.6 million for it. Other musicians who also sold their creations in the form of NFT include the band Kings of Leon and the singer Weeknd.

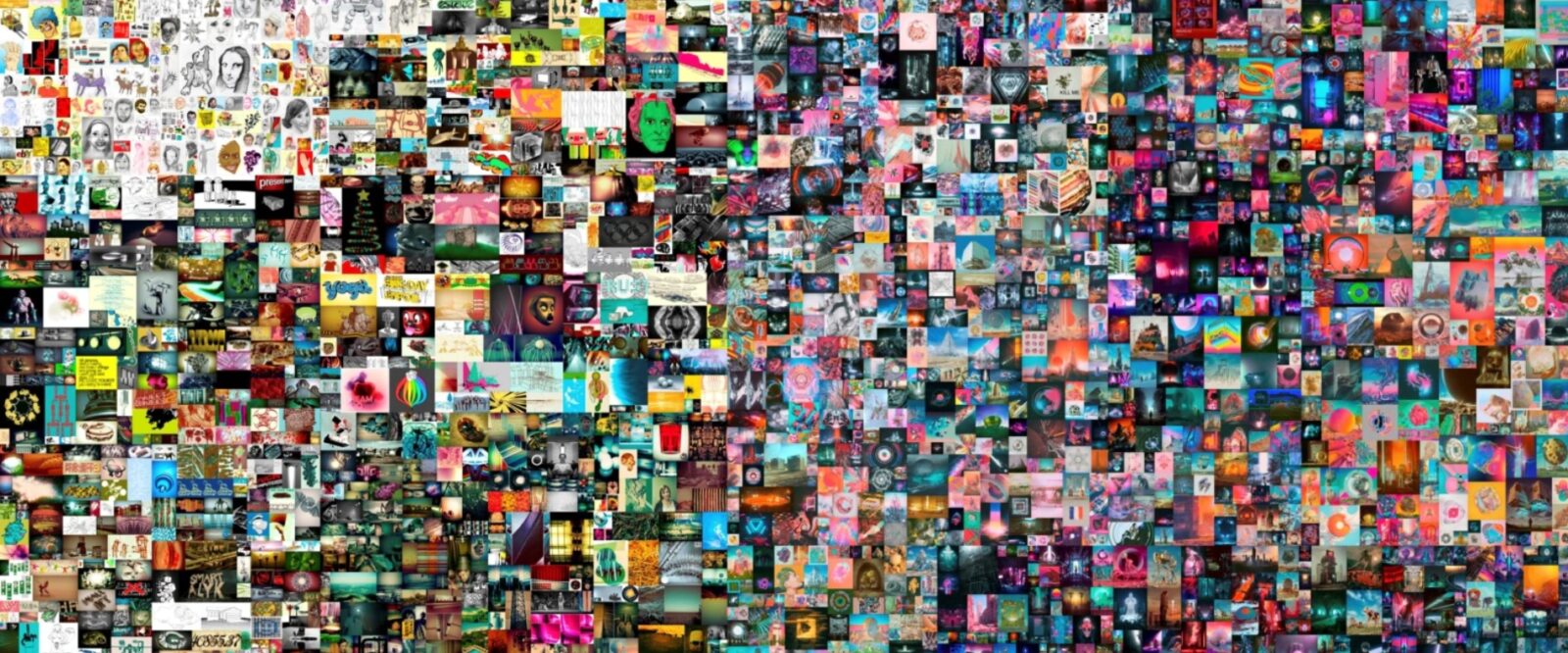

The record sale was for artist Mike Winkelmann’s (aka Beeple) painting “Everydays: The First 5,000 Days.” A JPG-file consisting of all the images that the artist painted every day for five thousand days was sold for $69.3 million. The picture of Winkelmann became the first NFT-work sold in the history of the auction house Christie’s.

Non-exchangeable tokens are of interest not only to artists, but to major publications as well. The Times Magazine sold three of its covers (including the iconic “Is God Dead?”), and The New York Times sold its column with the telling title “Buy this column on blockchain!”

Not only music tracks or drawings, but also models are being auctioned off as NFT lots. For example, Canadian artist Krista Kim was able to get $520,000 for a minimalist model of a house designed in Martian settings.

I created an NFT. What should I do now?

There are a large number of marketplaces that work with NFT. Some are highly specialized marketplaces and differ in the categories of objects for sale: somewhere you can find items for video games exclusively, somewhere – digital art.

Notable ones include OpenSea, Rarible, Niftygateway and SuperRare. The platforms charge a fee in ether (the exchange unit of the Ethereum cryptocurrency, which is the basis of its infrastructure and the creation of non-interchangeable tokens. The amount of commission varies, but is usually in the tens of dollars.

Some services immediately generate a token from the uploaded file (and charge a commission immediately), while others create an NFT only at the time of sale.

We hadn’t heard of NFTs before. Have they been around very recently?

Although blockchain and cryptocurrencies have been around for years, NFT is a relatively new phenomenon.

Tokens of this kind were created back in the mid-2010s, but the first NFT projects became available only in 2017. The popularization of NFT, which people are now earning millions of dollars with, was originally credited to CryptoKitties, a game in which you can breed virtual cats. The game became extremely popular, and the amounts for which you can sell digital pets exceeded $100,000.

Professor Donna Redel – formerly the managing director of the World Economic Forum and now an expert on blockchain and cryptocurrency at Fordham University – shares her views on the development of NFT.

She notes: “the ‘resurgence’ of NFT in 2021 is closely tied to advances in the blockchain infrastructure itself. “We’ve been watching the continued development of blockchain,” says Redel. – People have been taking the bitcoin system as the basis, and that’s how the Lightning protocol (a payment protocol that allows instant transactions – GA note) came about. […] We also watched the development of technologies based on the Ethereum blockchain platform. People were building [the infrastructure of non-interchangeable tokens] rather than making purchases.”

Redel notes that the development of blockchain technology and the emergence of NFT services (many of which appeared in the past year) also coincided with other processes in society and the economy. A large number of new players, including non-professional traders and amateur investors, have emerged in stock markets (and cryptocurrency markets).

The democratization of the stock market (the apotheosis of which was the situation around Gamestop shares) coincided with a pandemic: being in self-isolation, alone with their devices, many people began to pay attention to new financial instruments.

A certain role in the “revival” of NFTs was also played by the information buzz around them. The big names in the news headlines in their neighborhood with NFTs couldn’t help but draw attention to them. It is one thing when NFT is talked about in narrow gamer communities, and another thing when celebrities such as Elon Musk, Banksy, or Paris Hilton release their tokens.

I bought a JPG picture in NFT format. Do I have all the rights to it now?

Rather, no. This is the main reason to criticize the new kind of token: after all, owning an NFT does not guarantee full rights to the item.

Take, for example, the uncomplicated viral video Nyan Cat, which is an animation of a cat flying through the sky, leaving a rainbow trail behind it. The creator was paid $580,000 for the NFT with the animated cat. However, if you want, you can still watch this video on YouTube, download it to your smartphone, or install a screenshot of it as a screensaver on your desktop, without fear that the NFT owner will demand payment from you.

As an example, mentioned by Redel, could be NBA Top Shots, which is the name given to spectacular moments in National Basketball Association games. That is, it is possible to buy an NFT that has a James LeBron shot or a Michael Jordan slam dunk attached to it.

“You can buy that ‘moment,’ but you don’t own the rights to it and you can’t dispose of it outside of the blockchain,” Professor Redel says. – You can’t borrow it, you can’t divide it into its component parts. You can only do what the owners of those moments (the NBA and Dapper Labs, creators of the aforementioned CryptoKitties) are allowed to do, which is to buy it, keep it in your collection, and sell it.

According to the Voice of America, the list of what can be done with NFT (and how it will relate to copyrights) may expand, but for now everything happens exclusively within the blockchain network.

It is possible to speculate that there may be other “moments” in a similar fashion. In theory, movie companies could sell snippets from your favorite movies in the form of NFT – that is, you could become the sole owner of a token tied to the final scene in “Titanic” or a dance from “Singin’ in the Rain.” However, unless you have other arrangements with the copyright holder, you won’t receive royalties at all every time that movie is shown, but you can make money by re-selling those scenes.