The future of Credit Suisse’s art partnerships hangs in the balance after UBS announced an emergency takeover of the fellow Swiss private bank on Sunday.

Credit Suisse’s stocks plummeted earlier this month following the collapse of Silicon Valley Bank and two other US lenders due to the Federal Reserve’s recent interest hikes.

The Swiss government subsequently strong-armed UBS to buy its defunct rival for $3.25bn and assume $5bn of its debt. Full details of the rushed deal—termed a “shotgun marriage” by some financial analysts—are yet to be revealed. Thousands of jobs at Credit Suisse are reportedly at risk.

Like many large banks, Credit Suisse has close ties with the art world. José Olympio da Veiga Pereira, Credit Suisse’s former chief executive officer in Brazil, is a major art collector and president of the Fundação Bienal de São Paulo. The bank also holds a large collection of Modern and contemporary Swiss art, and financially supports seven art institutions in Europe—six in Switzerland and the National Gallery in London.

In recent years, these institutions have been scrutinised for their relationship with the bank following revelations by the Guardian that linked many Credit Suisse clients to serious crimes, including human trafficking and torture.

UBS says it is too soon to discuss the full ramifications of the takeover on the art world. A spokesperson for the bank says: “We recognise the important support Credit Suisse has been giving to arts organisations in Switzerland and abroad. It is too early to say what the additional program of partnerships and support for the arts will look like as we are still operating as two separate entities.” Credit Suisse has declined to comment.

However, six out of the seven Credit Suisse’s partner institutions contacted by The Art Newspaper said they would welcome UBS stepping in as a sponsor. The Kunsthaus Zurich, which Credit Suisse has sponsored for more than 30 years, “assumes that the new owner [UBS] will take over and fulfil the contractual obligations that Credit Suisse has entered into in sponsoring the Kunsthaus,” says a spokesperson for the museum.

Corporate sponsorships account for “less than 10%” of the Kunsthaus Zurich’s total income, of which Credit Suisse makes up around one-third—so less than 3% of its revenue, according to the spokesperson. This means that the Kunsthaus is “able to bridge a possible shortfall in the short term”. Nonetheless, he adds, “in the medium term, it will need a replacement if UBS does not continue Credit Suisse’s commitment”.

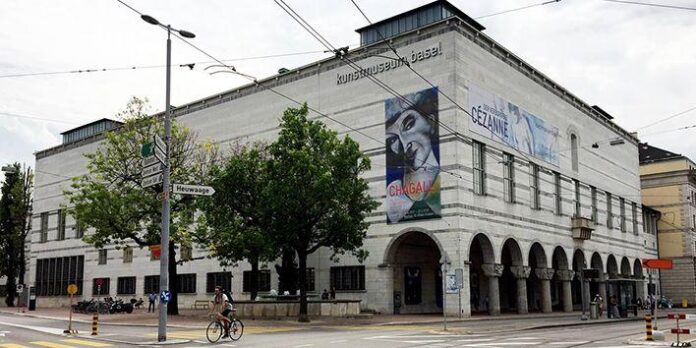

The Kunstmuseum Basel is also open to the prospect of UBS stepping in as a sponsor: “We have worked very well with Credit Suisse in the past and are also financially supported by other banks. For this reason, we see no reason to question the cooperation with banks, which is important for us. This also applies to UBS,” a spokesperson says. Credit Suisse has provided support for one exhibition per year at the Kunstmuseum Basel since 2012. This contract is due to run out next year.

London’s National Gallery—the only museum outside of Switzerland to maintain an official partnership with Credit Suisse—remains tight-lipped: “We are speaking to our colleagues at Credit Suisse about the current situation and have nothing else to add at this time”. However, like Kunstmuseum Basel, the gallery’s partnership is up for renewal next year.

Indeed, Credit Suisse’s collapse might offer these museums a much-needed pretext to cut ties with a controversial partner.

Kunsthaus Zurich’s contract with Credit Suisse is also up for renewal. “We have been in talks about the future of the collaboration for several months,” the museum’s spokesperson says, adding: “As a member of ICOM [International Council of Museums], the Kunsthaus Zurich respects the ethical principles stated by the professional organisation.”