One of the largest U.S. banks shared his vision for the future of the art market

Bank of America that not only has a corporate art collection but also provides art banking services for its clients, released its own mini-research. In a simple and accessible form, Bank of America analysts divided the current crisis into phases and made a forecast of the behavior of sellers and buyers in each of them. We offer the main results of the work to USA Art News readers.

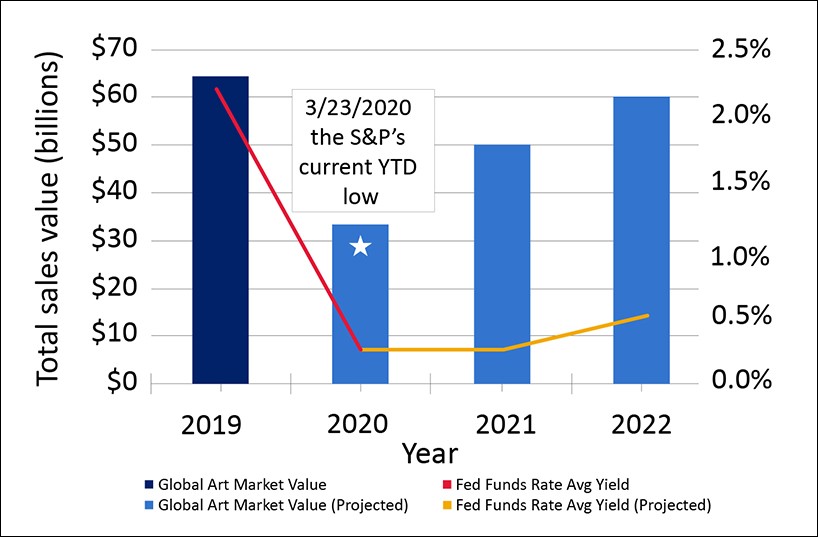

As you know, the art market performance lags behind the stock market and the global economy as a whole: its decline and growth come 6-12 months late. Over the past 30 years, the art market has experienced three major shocks: the recession of 1990-1991, the collapse of the technology market in 2001, combined with the terrorist attack of September 11, and the financial crisis of 2008-2009. The recovery of the art market after the last two crises was V-shaped, while the consequences of the 1990 recession were felt for over 10 years and the recovery was smooth, U-shaped. Bank of America analysts expect the art market after COVID-19 to avoid a steep collapse and continue to develop in three phases called “exit,” “adjustment,” and “recovery.

Exit (currently – autumn 2020)

As quarantine restrictions ease, local economies begin to move and the world restarts global business interactions, the Bank of America expects the art market supply (the quantity and quality of the works that sellers are offering to sell. to be limited until there is more economic clarity. At this stage, you should not expect large discounts from sellers: they are interested in stabilizing the market by keeping average prices for artists. During the last crisis, from 2008 to 2009, sales of art objects fell by 40%. This was not due to a decrease in price dynamics, but to the fact that the sellers refused to take art for sale at a discount that satisfied the owners, and thus deprived buyers of the opportunity to make profitable purchases. This approach will continue during the summer of 2020, but other factors will be added to the desire to limit the supply: logistics companies have frozen in anticipation of clarity with the international transportation of art, and auction houses, art fairs, and galleries are moving to online sales channels to ensure minimum income. The few works that go on public sale are likely to find surprisingly stable demand, as stimulating monetary policies in developed countries and bored, quarantined international collectors continue to buy. Summer auctions are likely to have limited supply, previously agreed guarantees, and stable demand: in total, this should maintain a stable price level.

Adjustment (autumn 2020 – spring 2021)

It is expected that starting from autumn the number of works coming to the market will increase dramatically and in some segments will be ahead of demand – for a short distance it will lead to lower prices. Galleries in need of cash flow, concerned about falling liquidity private dealers and shippers, who will be forced to psychologically accept lower prices, will adversely affect the art market. Demand, which depends primarily on the mood of collectors, will eventually be determined by medical restrictions, stock market level, and purchasing liquidity. Analysts expect pricing during this period to be slightly calibrated: the cost of rare works and masterpieces will remain stable, but the price dynamics of medium-level works of art and the primary art market are likely to be negative. In short, Phase 2 is the time to look for quality works and make profitable deals.

Restoration (Spring 2021 onwards)

The deflationary period in the art market should end with the strengthening of private capital, normalization of the corporate profit cycle, and recovery of general economic sentiment. With the beginning of a new period of the world, the economy will face inflation as a financial response to the consequences of the pandemic. This process should bring capital back to the art market because the supply of art is limited by nature and therefore not subject to inflation – in particular, the Federal Reserve Fund can not finish printing Picasso paintings as U.S. dollars. The primary market and young contemporary artists will lag behind more well-known and investment-attractive authors in the rate of growth. Museums will have to tighten their belts for a while and only dream about adding to their collections. It will take years for medium-sized galleries to fully recover, and some may close. Well, developed top galleries will only get stronger against this background, and the number of art fairs will decrease. Bank of America predicts the development of virtual trading platforms, online auctions, and digital channels of communication and communication with customers, but at the end of Phase 3, the art market expects “digital redistribution”: some collectors will return to social and “tactile” purchases in physical spaces, while others will remain adherents of online transactions and communications.

Bank of America has identified three main trends of the current crisis in the art market.

1. The art market system adapts quickly

The art market infrastructure is in a state of a sharp decline in the number of players. Galleries, auction houses, and museums have reduced or fired their staff and are now deciding how to work in the new environment. A new wave of consolidation is expected (merging small players into groups or merging with top market players. – AI.), as well as the closure of businesses – especially in the galleries, whose income lost up to 80% (and such in the world today most. – AI.). According to the American Museum Alliance (AAM) estimates, more than 30% of U.S. museums will not have the resources to open. Bank of America expects the fastest and most powerful in the history of the art market innovation cycle in terms of changing business models, mergers, and adaptation of modern technologies. In the future, this means a more accessible, transparent, and at the same time impersonal and a bit dull, the virtual art world.

2. Changing the strategies of auction houses

Last year three auction houses – Hindman, Bonhams, and Sotheby’s – changed their owners. The battle for market share has led to a revision of auction commissions, and social distance in 2020 has accelerated the transition of auction houses to new proposals and digital sales channels. It is expected that the model of “hybrid auction” will be widely used in the foreseeable future. There will be an increase in the number of multi-day auctions with an open bid form, lightning sales, and lots sold by auctions in private transactions. The role of business alliances in the public (Guardian and Christie’s collaboration in China) and the private sector (Sotheby’s Gallery Network project) will increase. Already now clients of large auctions have the opportunity to bid not only on art and luxury items, but also on collectible items from the fashion and design sphere, and in the future – even on financial and other art services exhibited in the form of lots.

3. Takeoff and correction of the technology market

Social distance has accelerated the transition of the art world to digital sales and communications channels. We saw the first high-profile 2020 project in March when Art Basel Hong Kong launched a fully virtual fair. All remaining art fairs are expected to have virtual sales galleries. A survey conducted by Bank of America among galleries and private dealers showed that virtual sales give an average of 25% of sales volume, which in recent years took place at physical fairs. At the same time, the new format provides greater price transparency, which means that it will be easier for collectors to make balanced and effective purchase decisions. Recent online auctions and digital art fairs have been surprisingly effective: up to 40 percent of the auction bids came from new bidders and recorded high sales. We may never again see a format like a daytime auction. As a result, it is expected that the art market will move into a hybrid world of digital technology, personal data, and live participation as soon as possible.

The Bank of America report notes the experience of the 2008-2009 financial crisis, which may help with forecasts and solutions in the current situation. Sales of art objects and antiques fell from $62 billion in 2008 to $39.5 billion in 2009, but by 2010 returned to pre-crisis levels. The return to the previous indicators was caused by the fiscal and monetary policy stimulating measures, similar to what we already see in 2020. Bank of America expects that the global economy and the art market in 2020-2021 will follow the same path. At the same time, the volume of the art market at the end of this year is projected in the report at $34 billion.

The report also contains four tips for collectors, but they have one goal – to promote the bank’s services related to art. At the same time, they are focused on U.S. law, and the benefit to readers of CIS countries is minimal. The tips are as follows: keep art in crisis, use it as a last resort as collateral (here and then ” through the Bank of America ” AIcoholics in the event of an asset at auction, use good art consulting to study the risks and determine the most appropriate auction house and country of sale, taking into account logistics, use temporary changes in tax rates of their countries to plan an inheritance today, do not forget about charity, which is a number of global laws will help to plan an inheritance.

Van Eyck. Optical Revolution

Museum of Fine Arts, Ghent

1 February – 30 April 2020

About half of the approximately 20 currently-known works by Jan van Eyck (approximately 1390 – 1411) will be collected in Ghent at the largest exhibition of the Flemish artist. The exhibition will include several recently restored works, including the outer folds of the Ghent Altar (1432) and “Portrait of Baudouin de Lannoy” (circa 1438-1440), which will come directly from the restoration department of the Berlin Art Gallery. The German restorers will remove the old lacquer and remove the dirt accumulated on the surface of the painting, restore the paint using modern techniques and apply a new coat of varnish. Relatively recently, during the cleaning of “Portrait of a man in a blue chaperone” (about 1428-1430), it was found that this is also the original van Eyck. Visitors will also have a unique opportunity to see two versions of the “Madonna by the Fountain” together – 1439 from the Royal Museum of Fine Arts in Antwerp and 1440 from the Frick Collection in New York. The exhibition will be complemented by many events under the Flemish Masters project, a series of three annual programs dedicated to different artists.

Marble Torlonia. Collection of Masterpieces

Capitoline Museums, Rome

3 April 2020 – 15 January 2021

One of the world’s largest private collections of antique sculpture, which has not been exhibited for half a century, will finally be available to the public in the Capitoline Museums. The importance of the exhibition is also emphasized by the fact that a number of exhibits will be placed in the hall with bronze sculptures, including the Capitoline Wolf, donated in the XV century to the people by Pope Sixtus IV. The exhibition is curated by Salvatore Settis, a renowned expert in antique art and former head of the Getty Center, who organized an innovative exhibition of copies of classic sculpture for the opening of the Prada Foundation in 2015. He explains that the current exhibition presents a collection that includes earlier collections, including those dating back to the 15th century. Settis is confident that the exhibition’s design by architect David Chipperfield, as well as the fact that it tells five stories, will help attract visitors without a classical education. They include a story about the Torlonia Museum, which was open to the noble public from 1874 to 1940, as well as a section on archaeological finds made by the family during excavations on their vast estates. “We also tried to arrange the exhibits in such a way that even a person who does not specialize in antiquity would have questions,” adds Cettis.

Artemisia

National Gallery, London

April 4 – July 26, 2020

Leticia Treves, curator of the exhibition “Artemisia”, says that she will offer the audience a “comprehensive” view of Artemisia Gentileschi as a talented artist, storyteller, entrepreneur, “a determined, intelligent and deeply committed woman”. Chronologically, the exhibition, which will include more than 30 works, covers the entire 40-year career of the Italian artist and, according to Treves, “emphasizes her ability to adapt to different markets and tastes in the cities where she worked”. Educated in the Roman workshop of her father, Orazio Gentileschi, Artemisia declared herself an artist in Florence, returned to Rome in the 1620s and spent the last 25 years of her life in Naples. Recently acquired by the National Gallery, the previously unknown “Self-portrait in the image of St. Catherine” (1615-1617) will be presented for the first time next to such masterpieces from the collections of other museums as Artemisia’s first signed work “Susanna and the Elder” (1610) and the fascinatingly bloody “Judith and Holofernes” (1611-1612). One of the halls will be fully dedicated to the images of this heroine and, according to the curator, will demonstrate how Artemisia “first showed the traditional plot from a female point of view.

Masterpieces from the London National Gallery

National Museum of Art, Osaka

July 7 – October 18, 2020

For the first time in history “Sunflowers” (1888) of Vincent van Gogh will come to Japan – along with 60 more paintings from the collection of the National Gallery of London. This is the largest number of works of art ever to be exhibited in another museum. Japanese spectators, as well as guests of the Summer Olympics will see masterpieces of different epochs – from the Italian Renaissance to the twentieth century, including works by Paolo Uccello, Diego Velasquez, Antonis van Dyck, Claude Monet, William Turner and Pierre-Auguste Renoir. Along with Van Gogh’s Sunflowers, the exhibition will include such outstanding works as Rembrandt’s Self-Portrait at the Age of 34 (1640) and Jan Vermeer’s Girl Beyond Virgins (circa 1670-1672). The blockbuster will open in the spring at the National Museum of Western Art in Tokyo (March 3 – June 14), move to Osaka in July, and then go to the National Gallery of Australia in Canberra (November 13 – March 14).

Marina Abramovich. Afterlife.

Royal Academy of Arts, London

September 26 – December 8, 2020

You never know what to expect from Marina Abramovich’s exhibition. In 1974, during the performance “Rhythm 0” one of the spectators put a gun to her head. In 2010, at an exhibition in New York’s Museum of Modern Art, she spent hours looking for visitors in the eye. What awaits us in retrospect at the Royal Academy of Arts? A representative of the museum said that the artist will be in London for the duration of the exhibition and that “the exact nature of her presence has not yet been determined”. Among the works that will undoubtedly be included in the exhibition will be the work of Imponderabilia, first performed in Bologna in 1977. Abramovich and her then partner Ulai stood naked on the sides of the narrow entrance to the gallery so that the audience had to squeeze in. For the exhibition at the Royal Academy, Abramovich would not undress: specially hired performers would stand in the doorway. In addition, the exhibition will include new works – the artist reflects on the changes taking place in her body and the transition from life to death.

Raphael

National Gallery, London

October 3, 2020 – January 24, 2021

Raphael’s exhibition in London’s National Gallery promises to be one of the largest in history, with plans to bring key works from the Louvre, Vatican Museums and the Uffizi Gallery. Among the promised works are “Madonna with the Child and John the Baptist” (1508) from the Museum of Fine Arts in Budapest, also known as “Madonna Esterhazy” and “Madonna Terranuova”. (1504-1505) from the collection of the State Museums of Berlin. Both paintings will be exhibited together with such masterpieces from the National Gallery’s own collection as “Madonna with Carnations” (1506-1507). In total, the museum hopes to collect about 30 paintings by Raphael, about 20 of which will be provided by other institutions. In addition, the exhibition will feature important paintings by the artist, including a sketch of “The Head of the Apostle” for “Transfiguration of the Lord” (1518-1520), which came to England in the 16th century and was included in the collection of Chatsworth Castle. In 2012, it was sold at Sotheby’s for a record £29.7 million. The exhibition will see it coming from a private New York collection. The exhibition will cover Raphael’s work in all its diversity: in addition to paintings and drawings, it will showcase his experiences in archaeology, architecture and poetry, as well as printed graphics, sculpture, trellises and arts and crafts. In 2020, several exhibitions will be held at once to mark the 500th anniversary of Raphael’s death, including another large one in the Pontifical Stables in Rome (March 3 – June 2).

Nero. Life and heritage

British Museum, London

November 12, 2020 – March 28, 2021

Nero (37-68 AD) is an archetypical villain, a Roman who is loved and hated by all students of ancient history. Without exception, all his achievements during the 14 years of the Roman Empire – he was the last emperor from the Julian-Claudian dynasty – are overshadowed by stories of murder, intemperance, depravity, and cruelty. Thanks to the ancient authors – Suetonius, Pliny the Elder, and Tacitus – we know about Nero’s propensity for patricide, maternal and fratricide (i.e. almost all major types of related murders), his sexual interest in both sexes (and the more inaccessible the object of this interest, the better), and his insane extravagance. The most vivid illustration of Nero’s love for exquisite things is his “Golden House” with gold, gems, and ivory finishing, a statue of the Emperor himself 36 m high, and a banquet hall rotating day and night. According to some authors, during the great Roman fire of 64 A.D., which destroyed two-thirds of the city, Nero played a lira admiring the “beauty of the flame. The British Museum will try to separate the truth from fiction in an exhibition that analyzes the contradictions in the sources and seeks an answer to the question of who Nero actually was. “Was he an inexperienced ruler trying to come to terms with changes in political diversity, or a ruthless mother-killer maniac? – the organizers are asking the question. Let’s see.